Plastic surgery is often labeled as cosmetic because it typically is, but there are always exceptions to the rule. Procedures fall under two categories – elective or reconstructive – and this crucial detail makes all the difference when figuring out what you’re paying out of pocket. Getting a nose job because you don’t like the way it looks is not the same as medically requiring a rhinoplasty because several bones in your face are broken, causing an obstruction in your breathing. The same goes for other operations and treatments, from breast operations to Botox.

Basically, if a doctor believes a procedure is required to improve the quality of a patient’s life for health reasons, Insurance providers may cover some, if not all, of the costs. Addressing functional disabilities and deformities is essential, so this little caveat covers a vast cross-section of procedures, from invasive to evasive, and it’s important to know if plastic surgery could remedy whatever condition from which you suffer.

Here are a few examples of cosmetic procedures that may be covered by insurance because of their reconstructive or life-saving potential.

Breast surgeries

When people think of “boob jobs” their mind probably goes to a vixen with a buxom chest, but that’s a stereotype that is often misconstrued. Breast augmentation is the most common plastic surgery procedures in the country but it is not solely used on those seeking a more enhanced physical appearance. Breast cancer patients who have undergone mastectomy seek out plastic surgery to return their breasts to a close to pre-diagnosis status. It’s no surprise that health insurance providers will cover most surgeries involving a breast cancer diagnosis but some may be surprised to learn that their reconstructive surgeries after a mastectomy may be covered as well. The Women’s Health and Cancer Rights Act of 1998, provides protections to patients who choose to have breast reconstruction in connection with a mastectomy. This coverage includes all stages of reconstruction of the breast to produce a symmetrical appearance which is achieved by either breast implants or Autologous reconstruction. Reconstructions under the WHCRA also covers the prostheses and physical complications of all stages of the mastectomy, including lymphedema.

Breast reductions also fall under this stipulation if they’re causing you physical pain. It’s not uncommon for a person who suffers from back problems, shoulder grooving, neck pain and other complications from a heavy chest to explore surgical options to alleviate the symptoms. Oftentimes your health insurance will cover Reduction Mammoplasty provided qualifying requirements are met.

Gynecomastia, or enlarged breasts in men, may be available through certain health plans as well. Healthcare providers understand that this situation can cause suffering in various ways. Many insurance carriers provide provisions to cover Gynecomastia surgery under medically necessary. It’s never a bad idea to see if a healthcare professional may be able to help, even if you think the condition is uncommon. Sometimes, gynecomastia is paired with male breast cancer. If malignancy is suspected, this is a factor that will be considered when deciding how to proceed.

Rhinoplasty and other facial procedures

You’re probably aware that certain nose surgeries can correct a deviated septum, but did you know your insurance could help pay for it? Rhinoplasty is another surgery that is quite commonly assisted for obvious reasons. Insurers will cover procedures to improve the quality of a patient’s breathing. Other forms of facial reconstruction covered by insurance plans are those associated with severe facial trauma due to an accident.

Eyes

Having the excess skin around your upper eyelids removed is another possibility. Saggy upper eyelid skin may hinder your eyesight, so having them fixed is sometimes funded by insurance. To determine if an upper blepharoplasty would help correct your vision, a visual field test may be ordered by your primary care physician or your plastic surgeon.

Beauty marks and other skin blemishes

Blemishes are not well-liked, especially the life-threatening kind. Some “beauty marks” are, in fact, cancerous moles that could be fatal. Insurance providers commonly handle these circumstances for many reasons. Not only could it be essential to keeping you alive, but it also saves them money and time, in the long run, to handle the predicament before it becomes a crisis.

Panniculectomy

After extreme weight-loss, it’s common for excess skin to remain around the pannus and, in some cases, be heavy enough to cause pain and immobility. If this happens, you may be able to have a Panniculectomy (the surgical removal of surplus flesh) to reconstruct yourself covered under your health plan. Other procedures such as an abdominoplasty may be necessary in conjunction with the insurance covered panniculectomy for best results.

Botox

Often relegated by the masses to a mere aesthetic treatment, Botulinum Toxin can also treat some medical conditions. Migraine relief, for example, is a side-effect of this non-invasive procedure, alleviating the crippling agony. Hyperhidrosis can also be nursed with Botox. Appropriate medical history and documentation will be required by most insurances that do provide coverage.

Find out if your insurance can help

All plans are different depending on the person and circumstance, so there’s only one way to find out if your plastic surgery procedure is covered: Contact your insurance or doctor and ask. A solution to your quandary may be more affordable than you thought.

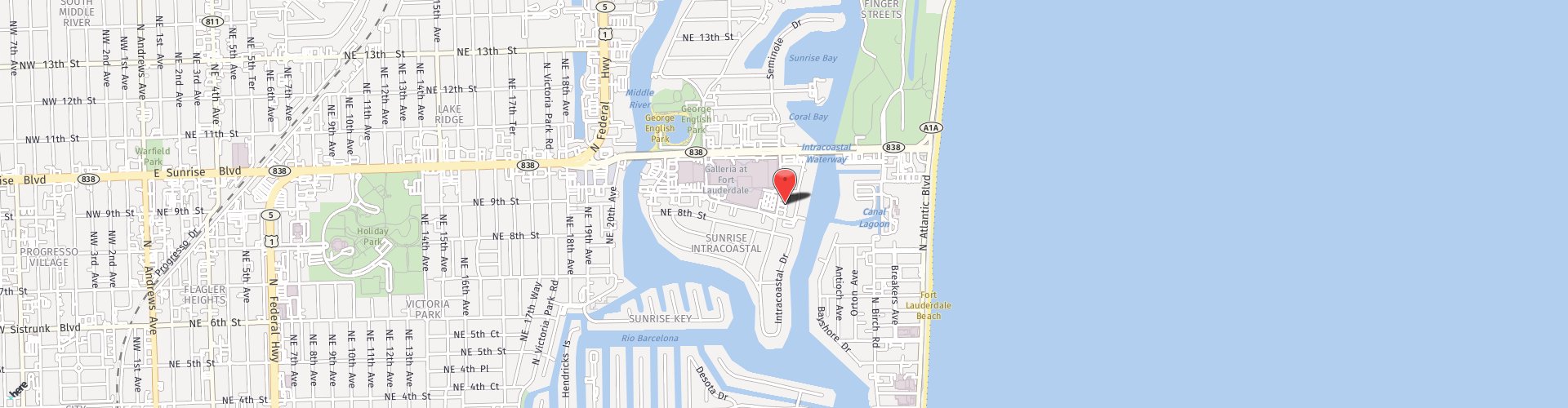

CRS specializes in sculpting the perfect you. If you or a loved one are considering a procedure, schedule your free consultation today by filling out this form or call 954-533-8029 and a representative will be in contact shortly. Plastic surgery is not recommended for everyone to schedule your consultation to see if you are a good candidate.